The change to the balance in your bank account will happen “naturally”—once the bank processes the outstanding transactions. For example, a restaurant or a busy retail store both process a lot of transactions and take in a lot of cash. They might reconcile on a daily basis to make sure everything matches and all cash receipts hit the bank account. On the other hand, a small online store—one that has days when there are no new transactions at all—could reconcile on a weekly or monthly basis. For the most part, how often you reconcile bank statements will depend on your volume of transactions. We’ll go over each step of the bank reconciliation process in more detail, but first—are your books up to date?

Acquire bank statements

Regular bank reconciliation saves you from having to review a full year of financial records—instead, you can quickly consult your reconciliation statements to review any required information. Outstanding checks are those that have been written and recorded in the financial records of the business but have not yet cleared the bank account. This often happens when the checks are written in the last few days of the month. The more frequently you do a bank reconciliation, the easier it is to catch any errors. Many companies may choose to do additional bank reconciliations in situations that involve large sums of money or that show unusual financial activity.

Fact Checked

Begin with a side-by-side comparison of your bank account statement and your company’s accounting records. Check that your financial transaction records include all payments and deposits for the transaction period, as well as the final balance. A bank reconciliation compares a company’s cash accounting statements against the cash it has in the bank. A bank reconciliation is used to detect any errors, catch discrepancies between the two, and provide an accurate picture of the company’s cash position that accounts for funds in transit. Before you reconcile your bank account, you’ll need to ensure that you’ve recorded all transactions from your business until the date of your bank statement. If you have access to online banking, you can download the bank statements when conducting a bank reconciliation at regular intervals rather than manually entering the information.

Ensures Financial Accuracy and Cash Flow

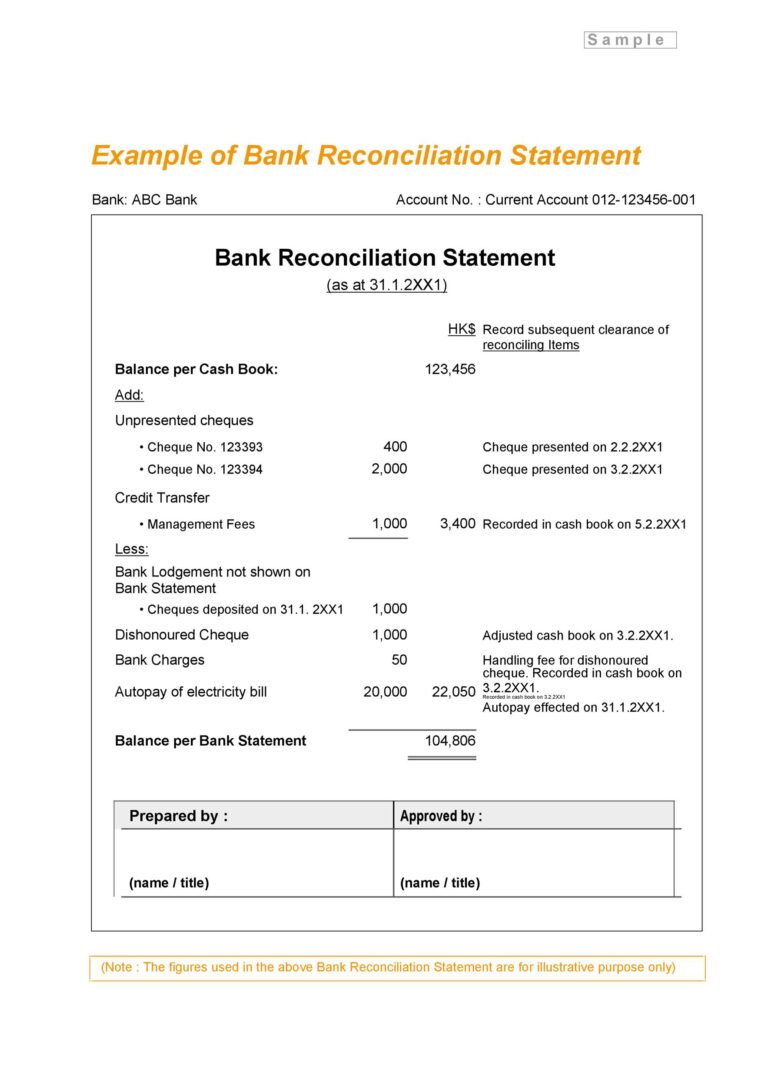

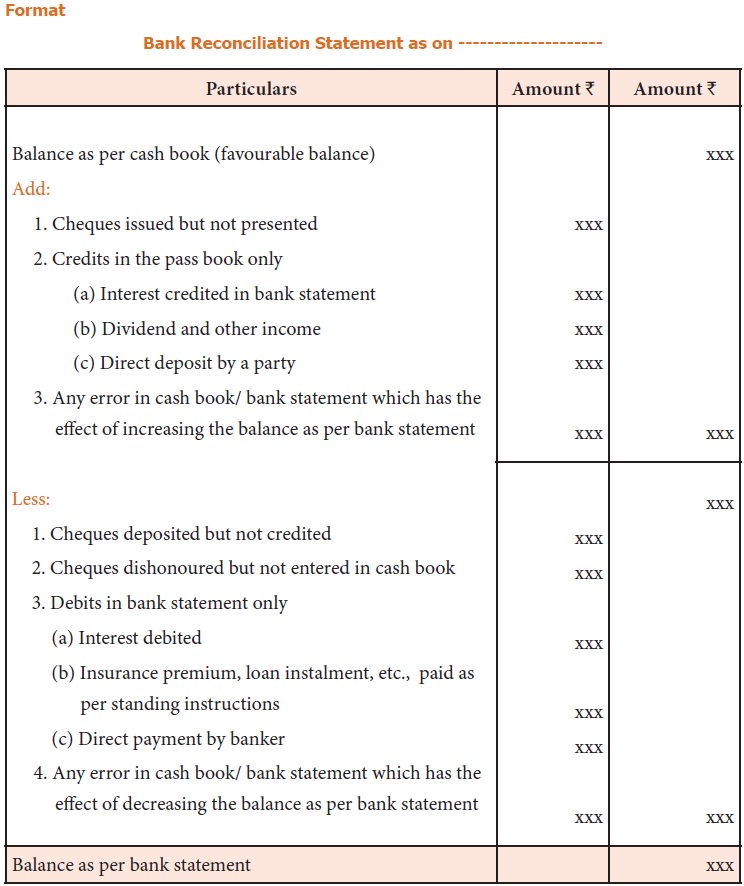

All of this can be done by using online accounting software like QuickBooks, but if you are not using accounting software, you can use Excel to record these items. As a result of these direct payments made by the bank on your behalf, the balance as per the passbook would be less than the balance as per the cash book. After adjusting all the above items what you’ll get is the adjusted balance of the cash book.

By using pre-configured templates, it simplifies the management of open items and enhances analytical capabilities. HighRadius offers a Record to Report suite that helps you and your business optimize your cash flow management and reduce reconciliation delays. With HighRadius, you can streamline and enhance the bank and account reconciliation process for your business. By leveraging the power of artificial intelligence, you can automate your processes and achieve 95% journal posting automation. Bank reconciliation is a subset of the monthly, quarterly, and yearly close process and is not generally done on its own. Accountants spend a lot of time on this step to ensure the checks are thorough and even minute errors are spotted.

- For larger companies with a high volume of transactions, it’s advisable to reconcile bank statements daily to ensure that any discrepancies or errors are promptly identified and corrected..

- Banks take time in clearing checks, so the bank needs to add back the check’s amount to the bank balance.

- You’ll need to adjust the closing balance of your bank statement in order to showcase the correct amount of withdrawals or any checks issued that have not yet been presented for payment.

- For example, say ABC Holding Co. recorded an ending balance of $500,000 on its records.

- These charges won’t be recorded by your business until your bank provides you with the bank statement at the end of every month.

The entries in the statement stop being the cause of discrepancies after a few days. The bank reconciliation statement explains the difference between the balance in the company’s records and the balance in the bank’s preparing a bank reconciliation records. Discrepancies between the balance sheet and the bank statement must be identified and resolved promptly. Failure to do so can lead to further errors and make it challenging to reconcile the accounts.

If an error is identified during the reconciliation process, it’s not always at the company’s end. Banks can also make errors, and if the mistake can’t be identified, contact the bank. Keeping track of the entire reconciliation process is crucial for reporting errors and corrections to the management team later. Documentation also helps non-reconciliation employees cross-check data and refer back to source documents.

A bank reconciliation is an essential process for ensuring that your company’s financial statements match the available cash in your business bank account. Performing regular bank reconciliations helps you stay on top of cash flow, keep organized records for tax season, and minimize the risk of fraud and theft. The purpose of the bank reconciliation is to be certain that the company’s general ledger Cash account is complete and accurate. With the true cash balance reported in the Cash account, the company could prevent overdrawing its checking account or reporting the incorrect amount of cash on its balance sheet. The bank reconciliation also provides a way to detect potential errors in the bank’s records. A bank reconciliation is part of the month-end close process, which includes reviewing the company’s balance sheet, income, bank statements, expenses, intercompany trades, and other information.