At the bottom of the income statement, it’s clear the business realized a net income of $483.2 million during the reporting period. As you can see at the top, the reporting period is for the year that ended on Sept. 28, 2019. A monthly report, for example, details a shorter period, making it easier to apply tactical adjustments that affect the next month’s business activities.

How do you calculate percentages in a common size income statement?

Ultimately, positive cash flow from financing activities left the business with a positive cash position of $13,000. In the future, the company can improve by decreasing investment expenditures and increasing revenue from operating activities. For instance, we can see that the gross profit margin and operating income margin have been quite stable over the last three financial years.

Common Size Balance Sheet Statement

The applications vary slightly, but all ask for some personal background information. If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice. Updates to your enrollment status will be shown on your account page. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for enrollment for any HBS Online program. Our easy online enrollment form is free, and no special documentation is required. We expect to offer our courses in additional languages in the future but, at this time, HBS Online can only be provided in English.

Common size horizontal analysis

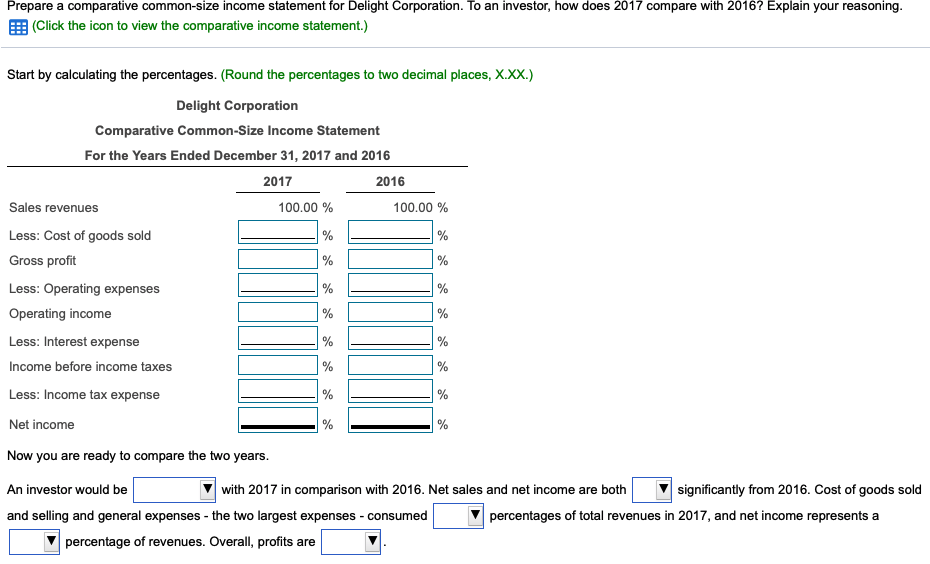

Common-size financial statements facilitate the analysis of financial performance by converting each element of the statements to a percentage. This makes it easier to compare figures from one period to the next, compare departments within an organization, and compare the firm to other companies of any size as well as industry averages. On the income statement, analysts can see how much of sales revenue is spent on each type of expense. They can see this breakdown for each firm and compare how different firms function in terms of expenses, proportionally. They can also look at the percentage for each expense over time to see if they are spending more or less on certain areas of the business, such as research and development.

- To perform a common size income statement analysis, you’ll compare every line on your profit and loss statement to your total revenue.

- Although the information presented is useful to financial institutions and other lenders, a common size balance sheet is typically not required during the application for a loan.

- They’re also used to analyze trends in items of expenses and revenues and determine a company’s efficiency.

- In this ratio discussion, I talked about ratios being “high” or “low.” Some can be determined internally, like the DSCR.

- The same process would apply on the balance sheet but the base is total assets.

However, the net income has witnessed a slight improvement during the same period. An analyst can further deep dive to determine the reason behind the same to make a more meaningful insight. A common-size analysis can also give insight into companies’ strategies.

For instance, in the above set of figures, the common-size income statement format makes it clear that the company is spending 50% of its sales revenue on producing goods. Taken in isolation, it’s impossible to say whether or not do you have to pay taxes on crowdfunded money this is good, bad or indifferent. On this income statement, the common size divides each line item by the total revenue. For example, if the cost of goods sold was $50,000 then you would divide it by $100,000 to equal 50%.

A horizontal common-size income statement is a financial statement that compares the percentage change of each item from one period to another. It helps identify the relative importance of different income statement items and highlights company performance changes over time. A common-size financial statement displays line items as a percentage of one selected or common figure. Creating common-size financial statements makes it easier to analyze a company over time and compare it to its peers.

In contrast, current liabilities, which are debts due within one year, make up only 30% of the company’s total assets. In addition, the company has more total assets than total liabilities. This common size income statement analysis is done on both a vertical and horizontal basis.

Let’s say that you’re looking into the line items on an income statement for a company. The items include selling and general administrative expenses, taxes, revenue, cost of goods sold, and net income. A company’s cash flow statement breaks down all of the uses and sources of its cash. It will typically get divided based on where the cash flow comes from.

Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields. You may have noticed the small trendline between the line titles and their amounts. The report provides a graphical horizontal analysis and a numerical vertical analysis.

A common size financial statement displays items as a percentage of a common base figure, total sales revenue, for example. This type of financial statement allows for easy analysis between companies, or between periods, for the same company. However, if the companies use different accounting methods, any comparison may not be accurate. While common size balance sheets are not a requirement of generally accepted accounting principles (GAAP), they offer a number of benefits to both internal and external parties. Generally accepted accounting principles (GAAP) are based on consistency and comparability of financial statements. A common size income statement makes it easier to see what’s driving a company’s profits.